Solutions for Investment Fund Managers in Luxembourg

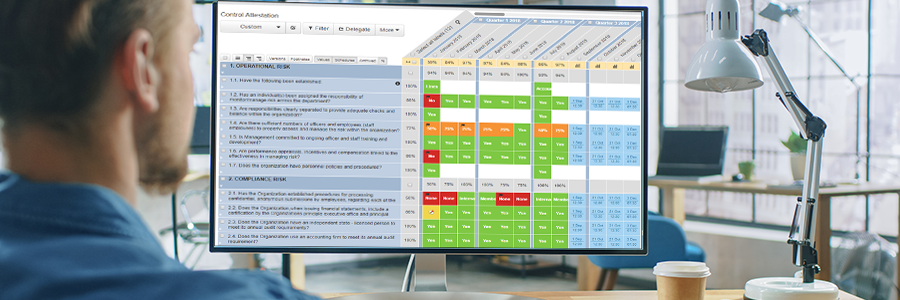

Oversight of risk and compliance programs was never so easy.

With automation and one centralised platform, ViClarity helps Conducting Officers oversee their Risk and Compliance program using powerful real-time views.

2022 is set to be another pivotal year for Investment Fund Managers in Luxembourg. As a finding from their 2021 'Observatory for Management Companies', PWC noted that digitalisation and automation are the biggest strategic opportunities for 2022.

A move toward digitalisation and automation is no surprise, as Fund management professionals have a lot of complicated risks and regulations to balance. Whether it's CSSF 18/698, regulatory deadline tracking or risk management, with ViClarity, you can gain a comprehensive view of areas of concern within minutes. Our industry-specific solutions help you track your GRC obligations in one centralised location.

Our core modules in the space include:

- Compliance Monitoring (Chapter 15/16 and CSSF 18/698)

- Regulatory Obligations Tracking

- Operational Risk Management

- Outsourcing Management

We also have many other solutions that can automate any manual spreadsheets or processes. For more on these check out our main Fund Management Page.

Find out how ViClarity can make it easy to manage governance, risk and compliance for your organisation.

Request a Demo