Peninsula Federal Credit Union Levels Up Audit & Compliance Processes & Reporting

October 5, 2023

Since their founding in 1941, Peninsula Federal Credit Union has grown tremendously from a humble beginning with 231 members to now serving more than 14,000 members at three locations in Michigan. Throughout the years the organization has remained steadfast in its mission as a credit union – serving members comes first and the community is strongest when everyone is working together.

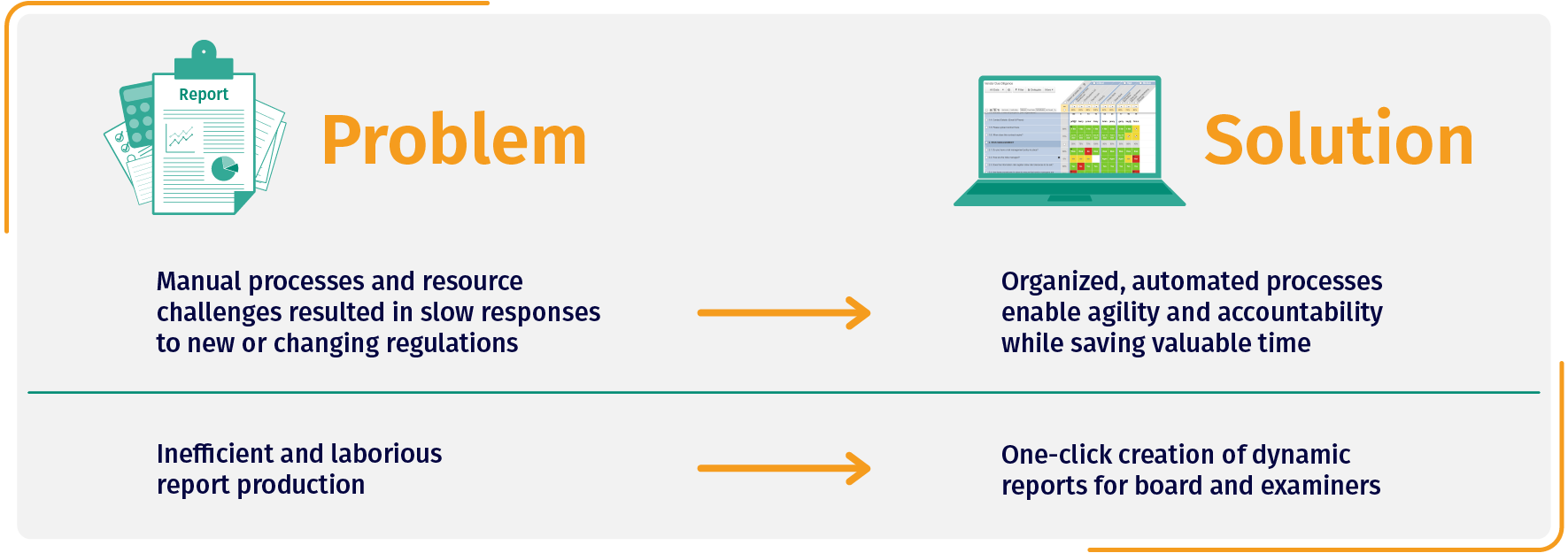

Prior to implementing ViClarity’s technology solutions, Peninsula operated compliance and audit processes through spreadsheets, which meant that all tracking, documentation and reporting was passed around manually. While this process worked for a while, the Peninsula team knew they could become more efficient.

Peninsula Federal Credit Union is now working with ViClarity to streamline their audit and compliance operations.

The Manual Struggle

The Peninsula team used to spend days compiling and creating reports that were clean and organized for examiners or committee meetings. When regulations changed, it took a long time to catch up to adaptations.

“Our processes became overwhelming with all of the regulation changes on top of our audit and compliance duties, and we did not have enough resources to manage all the work,” said Kimberly Parker, VP of Risk Management at Peninsula Federal Credit Union. It was time for a change.

Many teams struggle with keeping on top of manual processes like creating reports, copying and pasting data, and managing documents and tasks through email – all of which prevents strategic action. Like many others before them, when Peninsula Federal Credit Union identified these challenges, they turned to technology to help bridge the gap.

Tackling Inefficient Processes

Peninsula knew that selecting a solution could be a tricky task. It needed to fit their budget, speed up their work, and eliminate manual processes. Parker looked to ViClarity. As the biggest influencer on software selection in her organization, she wanted to ensure that ViClarity’s platform would fit what her team needed.

“I did my due diligence. I liked the flow of the [ViClarity] system and how everything was centralized in one place – not to mention how easy it was to build,” said Parker.

After Parker and her colleagues identified ViClarity as their top pick, the decision still had to go to Peninsula’s CEO and Board of Directors for approval. Everyone was willing to work together to create a more manageable and efficient process for the team, so they could focus on using their findings to improve experiences for their members.

Reporting Made Easy

One of the biggest payoffs for Peninsula, besides improved efficiency and tracking, has been the ease of reporting.

“Previously, I made all of my reports on spreadsheets. The process was laborious, and it took my team and me a whole day to prepare reports for our committee or examiners,” said Parker. “There was a lot of preparation that went into creating them.”

Now Parker can create reports in a matter of minutes and pick out specific details that she wants her committee to explore closely. Gone are the days of losing key findings within spreadsheets.

“It’s by far my favorite detail about the software,” said Parker.

Download Case Study

Back