NuMark Credit Union Partners with ViClarity for Audits & Benefits from Exceptional Reports

June 3, 2024

NuMark Credit Union serves more than 50,000 members throughout Chicago and its suburbs. As a full-service credit union, NuMark has provided everything from mortgage and auto loans to free checking accounts and business services throughout its 65 years. The cooperative is dedicated to “putting members first, treating them like family and helping them do more with their money.”

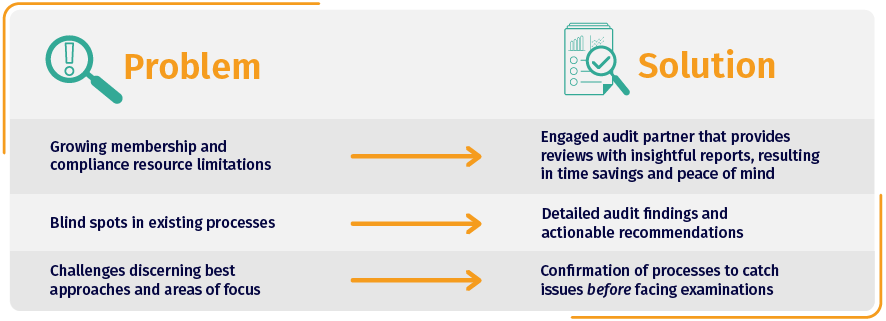

With a growing membership, NuMark faces new challenges and opportunities every day, which can bring new regulatory requirements to bear. As a preemptive step, the organization chose to build its compliance team and formalize its processes, but with a small team it can be hard to catch everything. To help bridge the gap, the team started looking for an extra set of eyes to help with audits.

Expanding a Successful Partnership

When looking for an audit partner to help formalize their process, the team at NuMark sought a group that specialized in compliance and understood the depth and nuances of the regulations the credit union must uphold. This is where ViClarity’s Audit Services team shined. Since NuMark had already worked with ViClarity on website and social media reviews for a few years, it felt like a natural choice to expand that partnership.

“Because of the work produced from the website reviews, I felt that [ViClarity] would be a great fit at homing in on those regulations,” said Michelle Balog, Executive Vice President and General Counsel for NuMark Credit Union.

Reaping the Benefits

Utilizing a third-party to review the credit union’s process and procedures and compliance with the regulations provided time savings and peace of mind for everyone involved. Previously, NuMark, like many other credit unions, struggled to determine if they were taking the right steps to ensure compliance.

“Our Chief Loan Officer was very happy that his concerns were being validated,” Balog said. “There were a couple things we weren’t sure if we were doing right or wrong and [ViClarity’s audit team] either validated our process or saved us time having to uncover what we didn’t know.”

An important part of a fruitful third-party audit partnership is confirming or shoring up your processes and catching issues before facing examinations.

“[ViClarity’s audit team] caught some issues with SAFE Act [compliance] that we had been doing wrong since Day 1 and they caught it right away. They asked all the right questions and for all the right documents. I was very happy with the presentation of findings as well, and they gave recommendations — not just findings,” said Balog.

"[ViClarity’s audit team] caught issues that we had been doing wrong right away... They asked all the right questions and for all the right documents. I was very happy with the presentation of findings as well, and they gave recommendations — not just findings.”

"[ViClarity’s audit team] caught issues that we had been doing wrong right away... They asked all the right questions and for all the right documents. I was very happy with the presentation of findings as well, and they gave recommendations — not just findings.”

- Michelle Balog

Many of the members of ViClarity’s Audit Services team worked in or for credit unions before their time at ViClarity, and it shows. They understand the obstacles facing credit unions and the importance of detailed, comprehensive reports of any and all findings and recommendations — and as an added benefit, they add suggestions for improvement or best practices.

“It was really nice to get the findings, and then they also gave us other observations that they noticed, and recommendations based on those observations. We loved the clarity of the reports,” added Percy Garay, Risk Manager at NuMark Credit Union.

Staying Compliant & Exam-Ready

To date, NuMark has worked with ViClarity on the SAFE Act, full-scale lending, deposit, and privacy audits, along with website reviews. Balog and her team plan to continue engaging ViClarity as additional audit needs emerge going forward. She’s not only confident in the quality of ViClarity’s work, but also knows she can be transparent about what NuMark prefers and expects, and the ViClarity team will respond with a plan based on her credit union’s specific needs.

ViClarity’s Audit Services department offers a variety of audits, including fair lending, deposit, privacy, required annual audits like ACH, BSA and SAFE Act, website and social media reviews, and more. Learn more about our audit services and contact our team for more information or to get on our schedule right away!

Download Case Study

Back