Affinity Credit Union Turns to ViClarity to Transform Vendor Management & Lending Processes

April 10, 2023

Affinity Credit Union serves more than 13,000 members in the communities of Central Iowa. They focus on providing experts who help members do more with their money and stop adding burdens on their journeys to financial success.

Affinity Credit Union serves more than 13,000 members in the communities of Central Iowa. They focus on providing experts who help members do more with their money and stop adding burdens on their journeys to financial success.

Before partnering with ViClarity, Affinity used spreadsheets and several different technology solutions to handle vendor management, risk management, board management, and lending reviews. While that approach worked for a while, Affinity started looking for a better solution to maximize efficiency and streamline their governance, risk and compliance processes.

Juggling Manual Processes

Although Affinity’s system of spreadsheets and inefficient technology worked for several years to manage vendor onboarding, criticality assessments and due diligence, the organization noticed inefficiencies that held them back from focusing on what they do best — serving their community.

Manual processes like copying and pasting data in spreadsheets prevents many organizations from unlocking their full potential and streamlining tasks for peak efficiency and progress toward the achievement of strategic initiatives.

While juggling these manual processes in addition to making time for analysis, Affinity Credit Union found it difficult to ever feel on top of their data. Each report or inquiry created a scramble as they looked for a clear picture of the most accurate information.

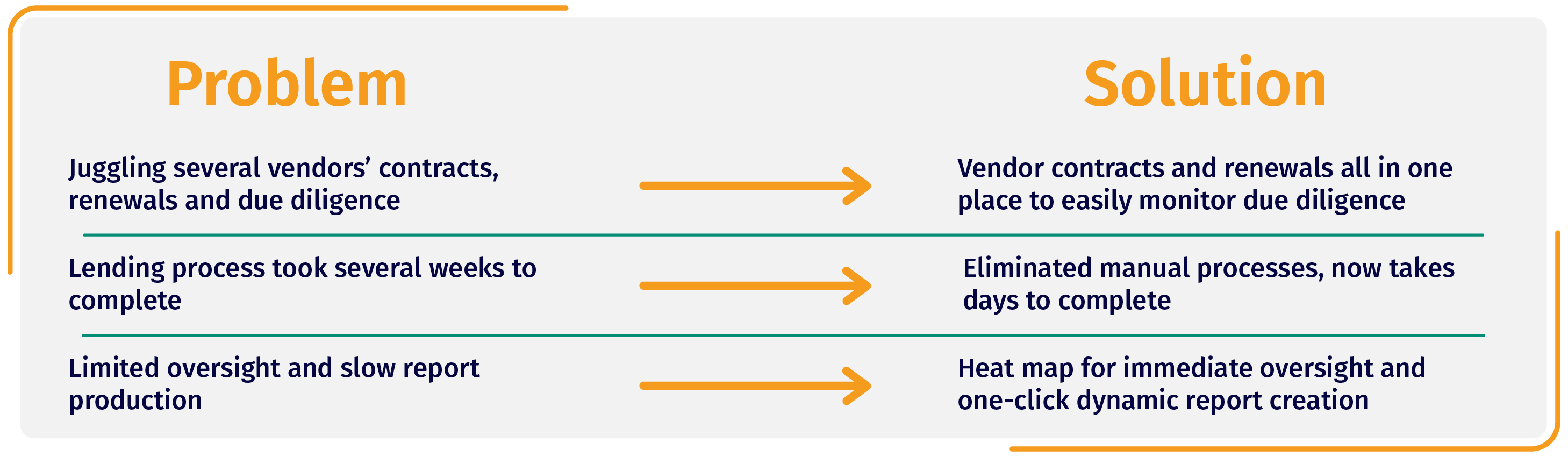

Tackling Inefficiencies in Vendor Management

The feeling of never being on top of data was the primary reason why Affinity Credit Union started looking for something more — a solution that could keep up with their organization’s demands.

ViClarity’s platform provides a transparent view into Affinity’s data, allowing their team to better track compliance issues, lending reviews and vendor management. The main focus for Affinity Credit Union was managing vendors.

“The biggest thing for us is being able to have all our [vendor] documents and renewals in one place. It really helps from an efficiency standpoint,” said Jeremy Smith, Vice President of Lending at Affinity Credit Union.

vendor management, Smith uses ViClarity’s technology to tackle other inefficiencies, like lending reviews. What previously took weeks to complete now takes days, streamlining processes and saving the lending team valuable time.

vendor management, Smith uses ViClarity’s technology to tackle other inefficiencies, like lending reviews. What previously took weeks to complete now takes days, streamlining processes and saving the lending team valuable time.

“It has had a significant impact on how we complete our post-closing lending reviews. Timewise these lending reviews are now done in days versus weeks, and it just creates new processes and controls we didn’t have before,” said Smith.

ViClarity’s data organization and reporting functionality enables the Affinity team to spot trends and identify needs at a glance — they can get fast answers and make smart, data-driven decisions. This is huge benefit when presenting information to a board member or regulator. It allows Smith and his team to track down reliable numbers faster, which has turned them into a more agile and responsive team.

Manual Processes a Thing of the Past

By replacing old manual processes and spreadsheets with ViClarity’s more agile system, Affinity Credit Union is saving time and providing peace of mind to themselves — and their members.

“From a manager’s point of view, it provides a ton of oversight and insight into what issues certain financial service organizations might be having, and we can get teeth around that faster,” said Smith.

Affinity Credit Union has been working with ViClarity since 2021 to streamline the way they work. Throughout this time they’ve solved new problems, saved time, and gained data oversight. Easy, efficient management controls allow organizations like Affinity Credit Union to focus on their mission: achieving financial success for their members.

Download Case Study

Back