What to Expect When Onboarding a ViClarity Solution

March 18, 2025

At ViClarity, we make getting started with our software an orderly, manageable process. On top of building configurable, easy-to-use solutions, we want to make sure it’s easy for your team to onboard and that you feel confident as a user. We understand that learning a new tech solution can be intimidating, but we’re transparent with our process so you’ll know exactly what’s happening along the way.

During Implementation

Understanding the scope of your software implementation is the first step to getting started. Logically onboarding one solution is faster than onboarding two (or more), but it all depends on the availability of both parties — ViClarity and you!

We prioritize your confidence and success with a dedicated team of PMI-certified project managers who guide your system setup and launch. They build a framework specific to your process and then spend time with you during deep-dive training sessions so you can work the new system into your routines. We work together to make sure all your users feel comfortable in the system and experience a smooth rollout with minimal disruption.

The entire onboarding process can take anywhere from 4-12 weeks depending on project scope and stakeholder availability. Getting you set up and using ViClarity to streamline your processes saves you time and money — and the sooner the better!

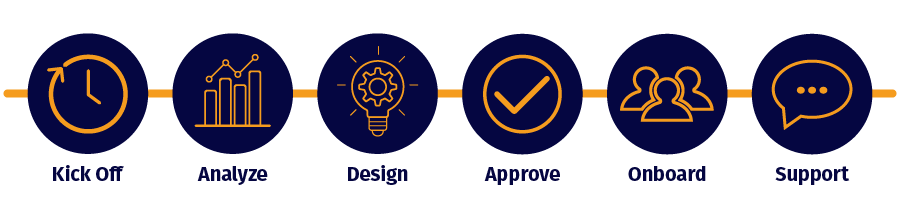

Kick Off

Implementation starts off with an introductory kick-off meeting to create a communication plan and set expectations. This is when you meet the assigned Implementation Manager who will remain with you throughout your solution set-up and onboarding. They are your go-to contact for all questions and ideas.

Analyze

After kick-off, the Implementation Manager collects documents and information that adhere to your specific requirements and processes — all the relevant regulations, procedures, or policies that you follow and that apply to the solution ViClarity is configuring for you. This determines the design and build of your solution, which we set up to meet your specific needs.

Design

During the design phase, your Implementation Manager and team work to create the workflows, functionality and dashboards that you will come to know and love. They work through a review process with the entirety of ViClarity’s team, including our architectural experts and quality assurance engineers, to test and review the solution.

During this stage you’ll spend some time going back and forth with your Implementation Manager to fine-tune the design until your organization is ready to approve the final step.

Onboard

For many ViClarity clients, this is the most time-intensive portion of the process because this is when solution training begins. The technical setup is done and now you need to learn how to use your new system. Our expert project managers and trainers will take their time teaching you the ins and outs of the solution to prepare you for smooth sailing.

Once you’re up and running, you will phase away from your Implementation Manager – but don’t worry! We’re not going anywhere.

After Implementation

It may be hard to say goodbye to your Implementation Manager, but this is an exciting transition. After a successful onboarding, you’ll meet ViClarity’s Customer Success Team and Technical Support Team, who will keep you operating at full speed. These folks are well-equipped to answer all your questions going forward.

Our Customer Success Team will continuously engage with you to ensure you maximize the system’s capabilities and stay in-the-know about product updates and industry trends. You can reach out to the Technical Support Team as needed if you experience any technical problems.

Back