Automation Reduces Administrative Burdens & Frees Resources for Acorn Life Risk Management Team

May 6, 2024

Like most risk managers, Sarah Whelan plays a critical role in ensuring that her organization maintains a clear picture of the key risks that face her business.

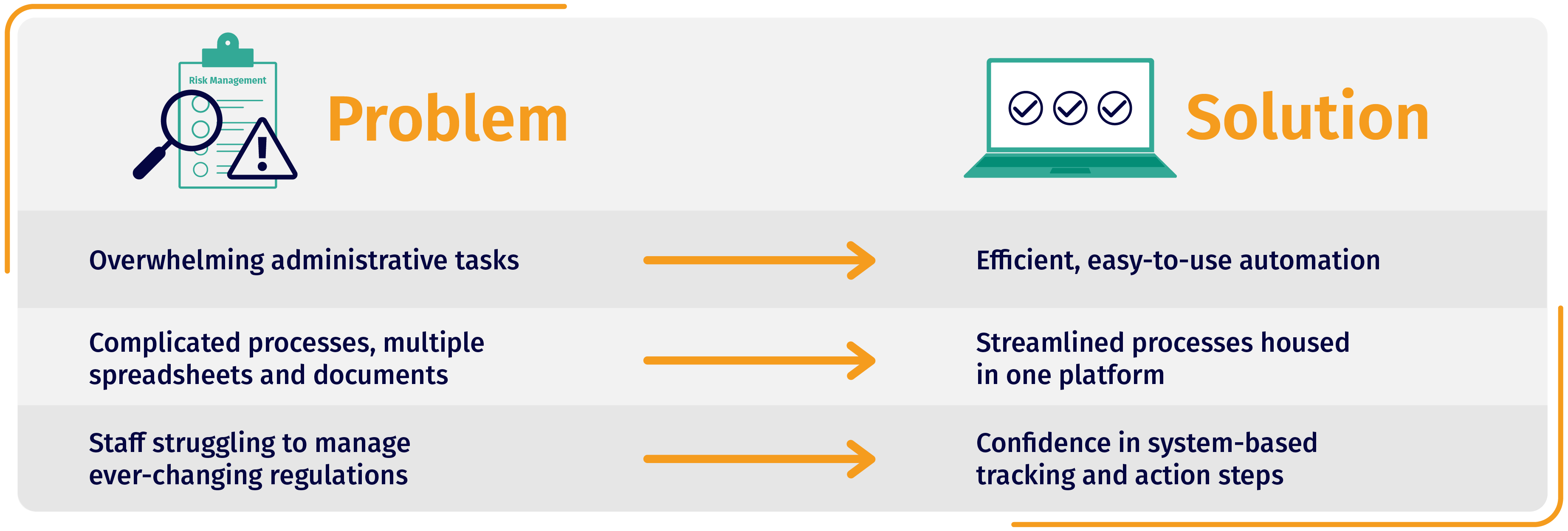

Obtaining that clear view wasn't always a straightforward process. The Acorn Life risk team was faced with an excessive administrative burden as they tried to capture and collate metrics on a mixture of Microsoft Excel spreadsheets and shared Word documents.

“Administrative burden had been getting excessive,” said Whelan, Risk Manager for Acorn Life. “We were at the point where the additional resource was required for administrative tasks. That requirement changed when we introduced to the ViClarity’s technology.”

Embracing Technology to Keep Focus on Strategic Initiatives

Acorn Life executives are responsible for the key strategic initiative of staying ahead of the ever-changing regulatory landscape and ensuring compliance with regulatory requirements. New and updated regulations related to outsourcing guidelines, operational resilience, environmental, social and governance (ESG) rules and others issued by their regulator, the Central Bank of Ireland (CBI), mean executive teams need time to focus on the bigger picture rather than grinding through administrative tasks.

By introducing ViClarity's risk management solution, Acorn Life eliminated manual and time-consuming data collection activities. With hours saved, key executives like Whelan are able to spend more time focusing on the company’s strategic plans, while the ViClarity platform provides the data needed to inform decision-making.

“The ViClarity team was very open about what the platform would deliver, and it has delivered. ViClarity has been very proactive in adding enhancements to the system, which isn’t a surprise, but it is good to see the platform is being kept up-to-date,” said Whelan.

Supporting a Risk-Focused Culture

Risk and compliance management needs to be more than a check-the-box exercise. Unfortunately, with increasing regulatory burdens and reporting requirements — along with the challenge of retaining talent — it can be a struggle to go beyond the bare minimum.

“ViClarity's risk management software has been a massive benefit to the risk management function,” said Whelan. “It reduces the operational risk associated with manual administration tasks. Everything was spreadsheet-based previously. We now have access to real-time information, and ViClarity's reporting functionality is extremely useful.”

For Whelan and the team at Acorn Life, implementing the ViClarity platform helped enhance a risk-focused culture by allowing the team to spend more time analyzing data rather than just chasing it. With reports now available in real-time, the team can focus on creating and closing out actions needed to mitigate risks.

According to Whelan: “The reduction in time spent on administrative tasks gives us additional time to focus on key strategic matters. ViClarity also allows us to keep track of our overall risk profile and provides us with a real-time view of our control environment, including controls, key risk indicators and risk scores.”

Ready to learn more about ViClarity’s configurable, integrated risk management solution? Reach out to us or request a demo!

Download Case Study

Back